Loans

Swiftly and Accurately Process Loans

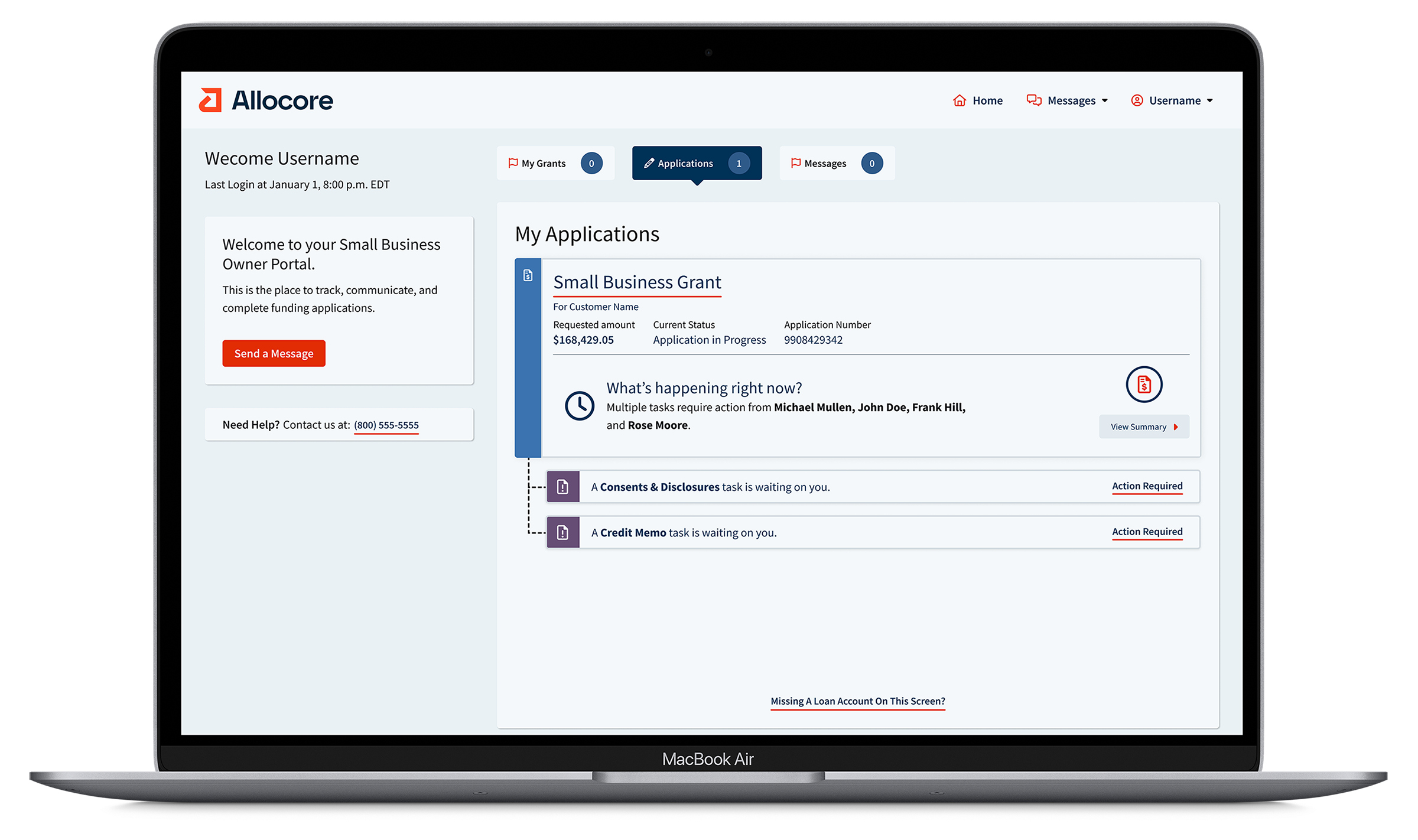

Track application status and easily make decisions on simple and complex applications.

Allocore powers the leading government loan, grant, and fraud programs with the expertise and efficiency of large commercial banking enterprises.

Track application status and easily make decisions on simple and complex applications.

Monitor applications and effortlessly make decisions throughout the grantmaking process.

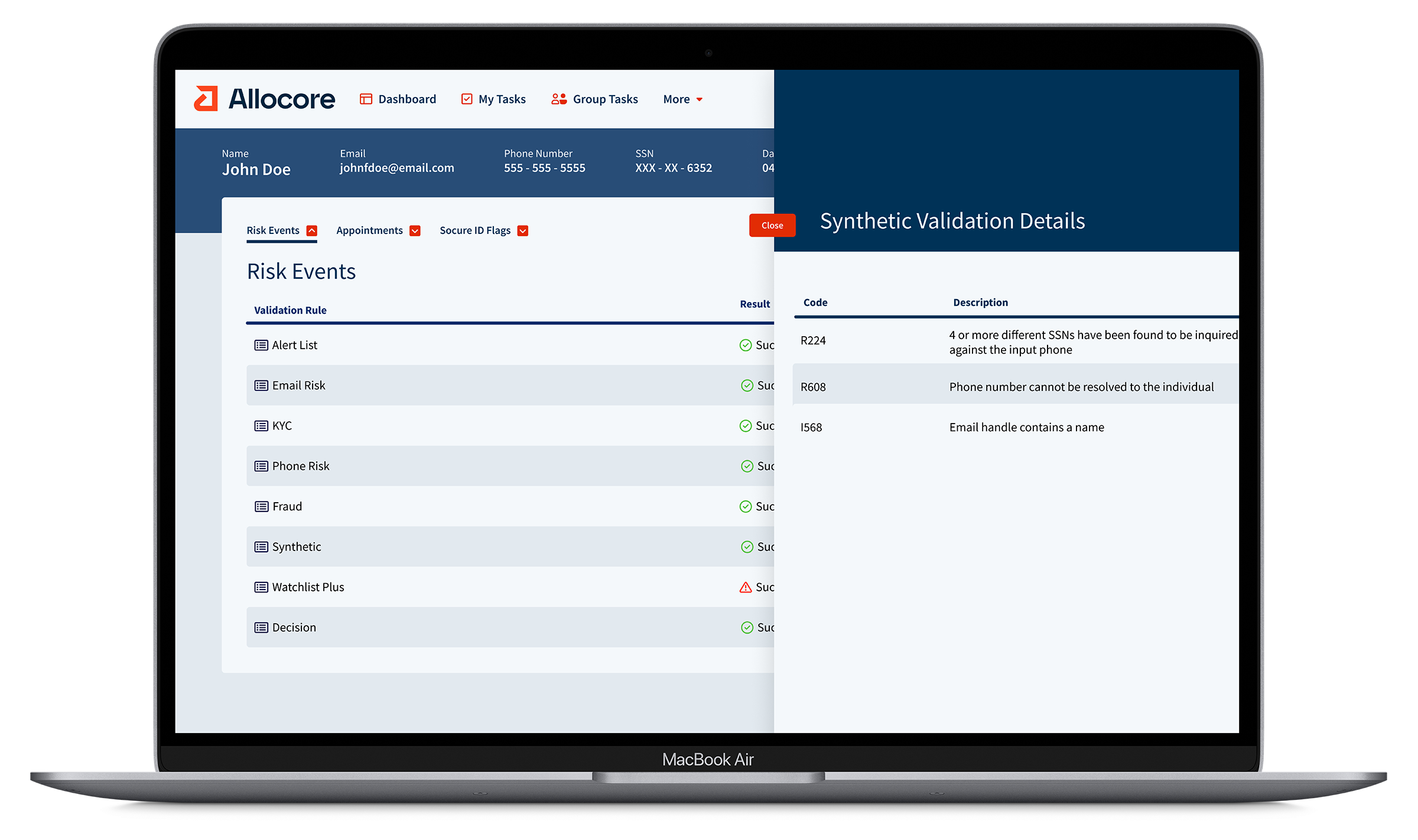

Apply innovative controls and fraud protection technologies to ensure applicants are validated.

Trusted by the most sophisticated banks and organizations.

Allocore is fully integrated with the leading vendors and tools providing best-in-class automation and loan and grant-making efficiencies—everything on one platform with full support and maintenance.

Delivering trusted cloud-native solutions with top-tier compliance and flexible deployment options to meet your unique requirements.