Report: Fixing Systems – What We Heard About Federal Fraud, Loans, and Grants

Lessons from Allocore’s Roundtable Series

Executive Summary

Throughout 2025, Allocore hosted a series of three cross-sector roundtables convening senior leaders from federal agencies, industry, academia, and policy circles to address some of the most persistent structural issues in public finance: fraud prevention, federal lending modernization, and grant process reform. Despite the range of topics, a common theme emerged: federal funding delivery systems are fragmented, outdated, and underpowered for the complexity and scale they now face.

This report provides an overview of the three Allocore-hosted roundtables. It summarizes the key discussions from each session, highlights the recommendations proposed by participants, and identifies recurring themes and cross-cutting challenges that emerged throughout the series. Together, these insights offer a roadmap for modernizing federal financial assistance programs through improved policy, technology, and collaboration.

The series was conducted under Chatham House Rules to encourage open dialogue and honest reflection from participants representing a wide range of perspectives. Each session surfaced both urgent pain points and promising opportunities for reform, shedding light on the operational, regulatory, and technological shifts needed to meet the moment. By bringing together experts from across sectors, the roundtables created a shared space to align on solutions and inform the path forward for more effective, accountable, and resilient federal funding programs.

March 6, 2025 | Accelerating the Fight Against Fraud Roundtable

Summary: The fraud prevention roundtable highlighted the staggering scale of losses, estimated between $233 billion and $521 billion annually, due to fraud across federal programs. Participants emphasized that fraud is not a series of one-off events, but a systemic vulnerability embedded in the outdated processes and siloed data structures that define most federal benefit programs.

During the pandemic, fraudsters exploited weak controls in relief programs, underscoring how porous federal systems remain. Panelists discussed how current compliance-heavy models often discourage proactive fraud detection and are mired in outdated legal frameworks that prevent cross-agency data sharing. Emerging technologies like AI-powered fraud detection, real-time anomaly tracking, and identity verification systems were proposed as crucial tools.

Participants focused on the following Recommendations:

- Deploying AI-based fraud detection in high-risk programs like unemployment insurance and Medicare. Rather than pursue fraud repayment and prosecution after the fact, agencies can implement AI-powered fraud-detection tools to reveal anomalies before funds are paid. As fraudsters become more advanced, the federal government must learn to leverage new technology to keep up.

- Modernizing privacy laws to enable real-time, secure data-sharing across agencies. Existing statutes like the 1974 Privacy Act and the Computer Matching Act prevent agencies from sharing fraud-related data quickly and effectively.

- Creating a centralized fraud prevention model akin to DHS’s Cyber Fusion Center, this structure would help break down silos, standardize fraud detection practices, and support smaller agencies lacking dedicated fraud units.

- Strengthening public-private partnerships to leverage commercial expertise and tools. The private sector has modern, scalable technologies that have already proven effective across industries. Adopting these systems will help

- Drafting a comprehensive OMB circular to streamline fraud-related compliance requirements.

Overall, the participants emphasized that fraud in government is not an isolated issue. It results from structural vulnerabilities fraudsters exploit at scale, particularly in emergency relief programs, disaster assistance, and federal grant distribution. The federal government must make reform a priority in order to protect taxpayer dollars and restore public trust in the system.

April 21, 2025 | Unlocking the Future of Federal Lending Roundtable

Summary: The discussion centered on the federal government’s $4.6 trillion loan and loan guarantee portfolio and the pressing need to modernize how these programs are administered.

Participants highlighted how decades of underinvestment, shrinking workforces, and reliance on legacy systems have created capacity and service delivery crises. Today, most agencies run their own homegrown platforms, many of which are 25 to 30 years old and are no longer maintainable.

Attendees recommended a shift to commercial-first platforms that are configurable and scalable, allowing agencies to share core functions like servicing and analytics via a marketplace model. They highlighted the importance of aligning administrative budgeting with long-term modernization goals, calling for multiyear funding, offsetting collections, and more flexible acquisition pathways. Another theme was borrower experience. Across federal credit programs, applicants face duplicative forms, inconsistent systems, and a lack of clarity. Participants called for a unified, user-friendly interface that streamlines the application and servicing process across agencies.

Participants focused on the following Recommendations:

- Shared services for loan servicing, analytics, and accounting modeled on Treasury’s QSMO. Adopting shared services could reduce redundant systems, cut costs, and make federal loan programs more consistent. Participants supported a marketplace model where agencies opt into shared services for core administrative functions, reducing the friction that comes from top-down mandated system change.

- Adopting commercial-first platforms that can scale efficiently and securely. Government agencies with bespoke, homegrown systems are finding them costly to maintain and difficult to upgrade. Participants advocated for a shift toward configurable, commercial-grade technology already proven in large-scale private-sector deployments, enabling faster implementation, stronger security, and long-term adaptability.

- Redesigning the borrower experience to eliminate duplication and confusion across agencies. Americans interacting with federal loan programs experience a repetitive and disconnected process, often submitting the same form multiple times across agencies. Participants suggested a unified, borrower-centric design to streamline applications in one place, easing the burden on applicants.

- Aligning administrative budgeting with modernization goals, including multiyear funding and offsetting collections. While loan subsidies are funded upfront, administrative budgets are allocated annually, creating a mismatch that stifles long-term planning and system upgrades. Participants proposed funding reforms to enable sustained investment in modernization, reducing dependence on uncertain year-to-year funding cycles.

With lending now a growing, central tool of federal policy, modernizing its delivery infrastructure is essential to ensuring effectiveness and resilience in the years ahead. Prioritizing commercial-first technology, enabling flexible and modular shared solutions, and aligning administrative funding with long-term modernization goals can unlock meaningful progress.

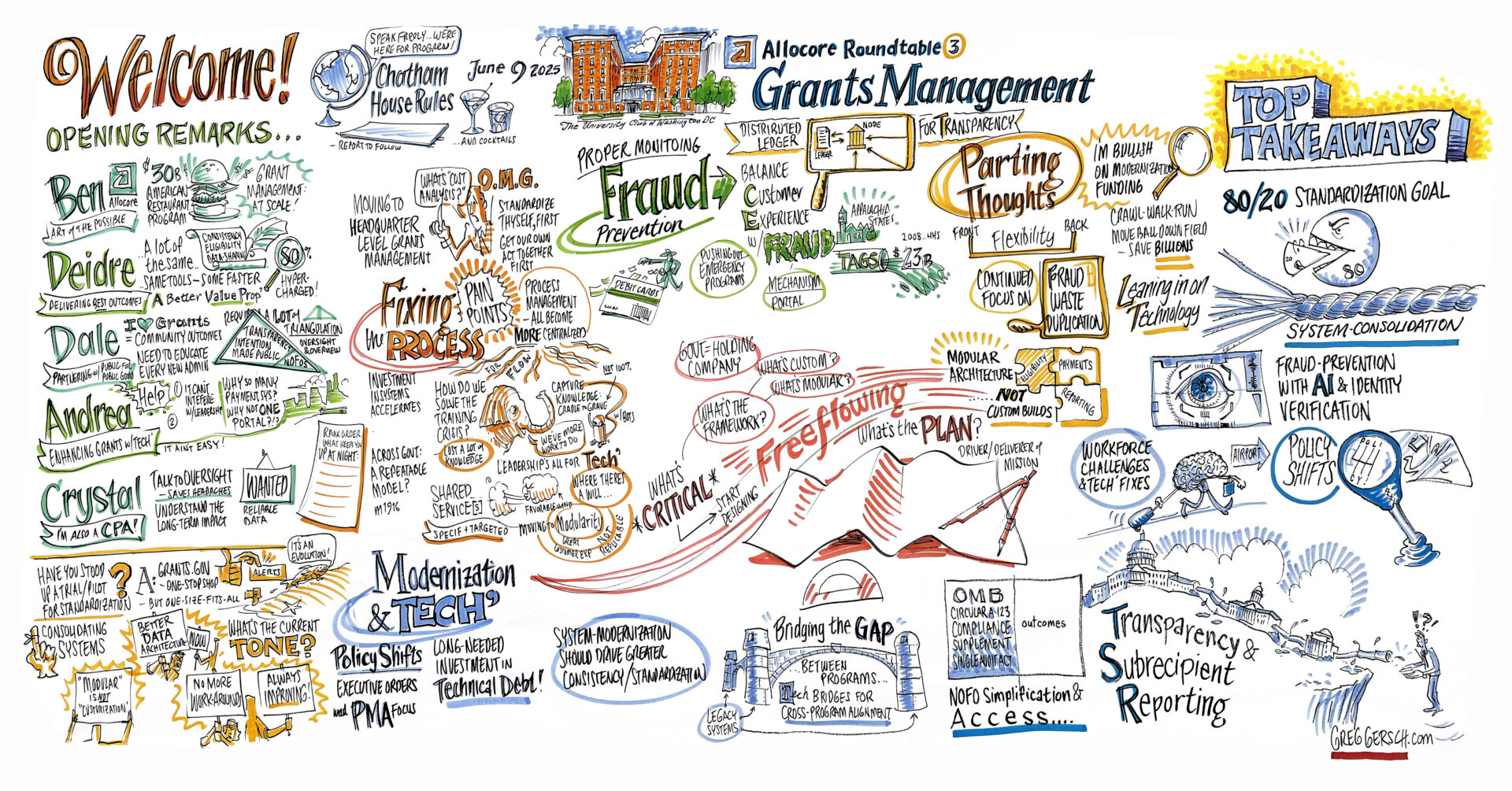

June 9, 2025 | Fixing the Federal Grants Process Roundtable

Summary: The third and final roundtable brought together senior leaders from government, industry, and the nonprofit community for an open conversation on grant management reform. The federal government distributes over $1 trillion annually in grants, yet agencies rely on more than 100 siloed back-end systems. The participants emphasized the need to simplify, standardize, and modernize grant management across the federal government.

Participants focused on the following Recommendations:

- Standardizing common business processes across programs—eligibility, performance metrics, and plain-language NOFOs. Participants emphasized the need to standardize 80% of processes across all grant-making programs, such as eligibility determination, reporting, and performance assessment, while still allowing the 20% of niche circumstances the flexibility they need.

- Building a unified front-end system to create a consistent experience for recipients, supported by modular back-end tools. Instead of requiring repetitive applications across each agency offering similar funding, users can go to a one-stop shop, where their options are clearly laid out. This system would also include real-time status tracking, with easy-to-navigate dashboards to help recipients better understand where they are in the process.

- Expanding data transparency through dashboards that track outcomes in real time. Once funds are awarded, the data becomes difficult to track, leaving awardees in the dark about where their funding is in the pipeline. Participants called for real-time dashboards and common reporting tools that make it easier to trace funding, measure impact, and enforce accountability at every level of government.

- Investing in the workforce, including consistent training and capacity-building across agencies. Many agencies face a shortage of trained staff and an aging workforce, leading to inconsistent knowledge of regulations and program requirements. Participants urged agencies to make strategic investments in staff development, utilizing tools such as automation and AI assistants to build long-term capacity and close critical skill gaps.

- Streamlining oversight without stalling program delivery. Overly burdensome oversight can slow down funding channels. The roundtable emphasized the need to reduce manual compliance workloads, possibly through embedded performance measures and automated tools.

- Clearing up NOFOs Language to ensure potential awardees know what funding is available to them. This would lessen the need for applicants to spend on professional grant writers, thus opening the door for newer and smaller applicants to participate.

The challenge now is to move from pilots and proposals to implementation. That effort will take political backing, agency leadership, and clear accountability. But the opportunity is undeniable. With over $1 trillion in annual funding on the line, there may be no better place to start building a smarter government.

Connecting the Dots

Across all three sessions, participants made one thing clear: existing systems are fragmented, outdated, and under-resourced, requiring sweeping reforms. Roundtable participants identified key issues with current practices, as well as a clear journey forward on the road to reform. Federal fraud prevention, lending services, and grant management all require modernization, standardization across agencies, and a renewed dedication to the recipient experience.

Modernization

The word “modernization” emerged repeatedly over each session, but participants stressed the importance of its meaningful implementation beyond just updating old technology. Agencies need to begin implementing AI and automation tools to make servicing more efficient. Additionally, agencies need to look to the private sector for inspiration on how to adapt commercial solutions to become more efficient.

Standardization

With the number of agencies providing loans and grants, as well as the 100+ management systems operating the back end, the network is ripe with redundant, duplicative systems wasting taxpayer dollars to complete the same task. Each roundtable recognized the need to standardize systems, language, and practices across agencies to reduce waste and confusion. Participants also stressed that, despite the difficulties in implementation, adopting shared services was a necessity.

Optimizing the Recipient and Borrower Experience

Though participants called for reforming internal processes to smooth out workflows, they also stressed the importance of the front-end experience. Recipients, whether applying for grants or loans, face redundant paperwork, inconsistent interfaces, and dizzying eligibility rules. Each roundtable agreed that reforms are needed to keep the recipient’s experience in mind.

Conclusion

Allocore’s roundtables revealed a common demand for change, as well as a hopeful path forward in federal grant management, lending services, and fraud prevention. Though traditional practices are unsustainable in a rapidly evolving world, the tools, models, and know-how already exist to build a smarter, faster, more accountable government.

Together, the recommendations from these roundtables offer a roadmap for modernization grounded in commercial best practices, shared infrastructure, and citizen-centered design. Though participants acknowledged the amount of work that must be done to achieve this goal, including inter-agency collaboration, advocacy for legal reforms, and dedicated funding, each roundtable concluded with optimism. We know the problem, we know the solutions, now we need action.

Allocore thanks the panelists and participants for their contributions to the roundtables and the subsequent analysis and recommendations that resulted from them.

About Allocore

Allocore powers leading government loans, grants, and fraud prevention programs with a unified platform built for efficiency and security. With trillions in loans and grants processed and billions in fraud prevented, Allocore brings the precision of commercial banking technology to the public sector.